Buyout Returns Soar While Hedge Funds Underperform

by Michael Roth

Private equity is an alternative asset class but we view it as a subset of the broader equity asset class. It shares this commonality with hedge funds which have been in the news a lot over the last few years because of their dismal returns. No story was bigger than CalPERS’ decision to exit hedge funds 18 months ago. However, the decision was not too surprising when you take a step back and look at hedge fund returns in relation to other asset classes.

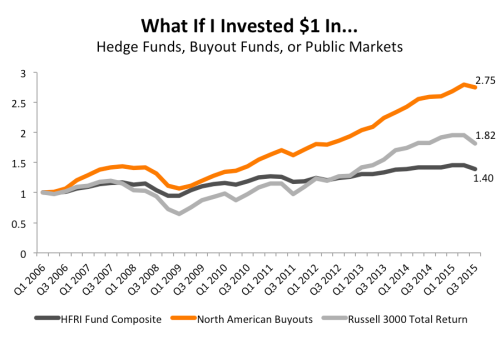

The chart below uses quarterly time-weighted returns to plot the growth of one dollar invested in three different buckets of the equity asset class since 2006.

From 2006 through Q3 2015, hedge funds have dramatically underperformed the North American buyout industry as well as the public markets. The chart above shows that $1 invested in the HFRI Fund Composite Index would have resulted in just $1.40 as of Q3 2015. That’s 49% lower than what $1 invested in the buyout industry would have generated as of Q3 2015.

Lower Risk Has Not Compensated for Lower Returns

The hedge fund industry could try to make an argument that lower returns have been in exchange for lower volatility and risk. However, the difference between the standard deviation of the HFRI’s returns and North American buyouts’ returns is less than 100 basis points. This reduction in risk is not nearly enough to compensate for a 49% lower return over the last 9.5 years.

Wrapping Up

Buyout returns have dramatically outperformed their hedge fund brethren. It’s a more complicated calculation that simply taking from one allocation and putting it into another but, given how stark the difference in returns has been, it’s surprising that we have not heard about a larger move out of hedge funds and into buyouts.